Feeling a bit unsure, or even afraid, to move with everything going on right now? The decision to move shouldn’t be scary, it should be exciting. And the best way to eliminate any fear is to work with a pro.

Real estate agents are so much more than just transaction facilitators; they’re trusted guides to help you navigate the complexities of the housing market with confidence and ease. And a great agent can turn what may feel like a daunting process into a manageable—and even enjoyable—experience.

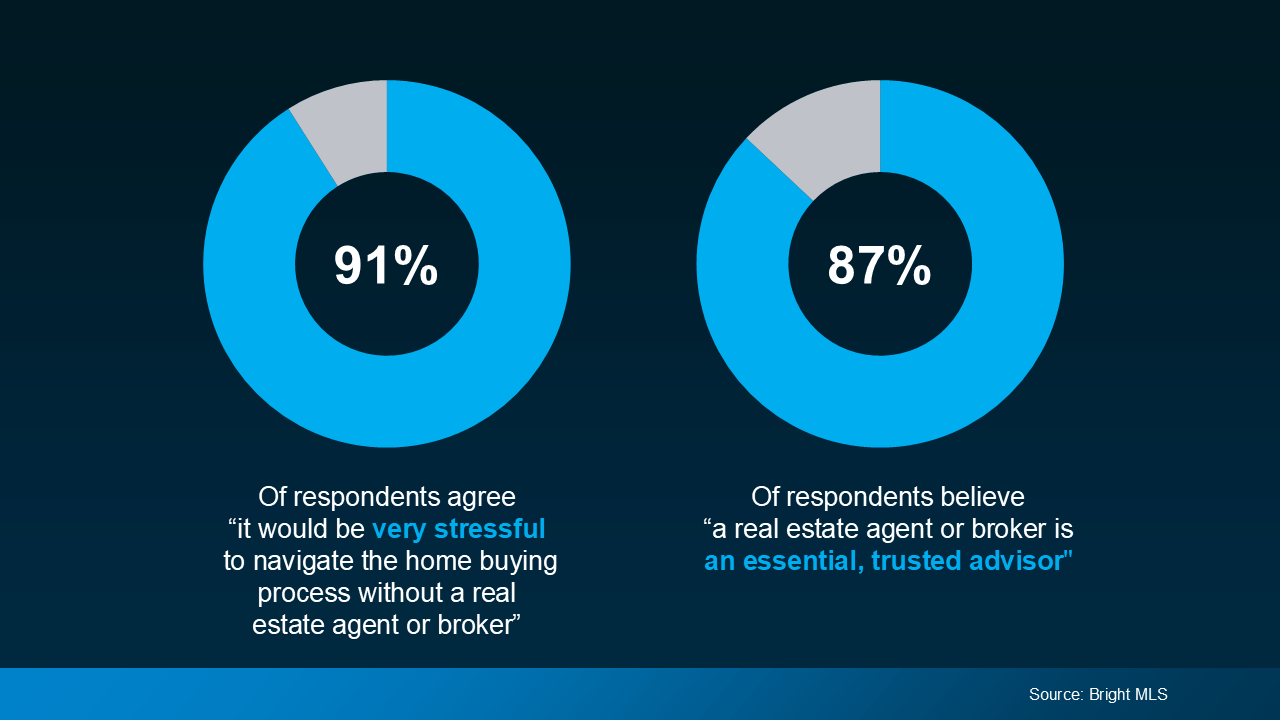

That’s why, in a Bright MLS survey, respondents agreed partnering with an agent is essential and helps cut down on their stress:

Here are just a few examples of why that expertise can give you so much peace of mind.

Here are just a few examples of why that expertise can give you so much peace of mind.

1. Explaining the Current Market

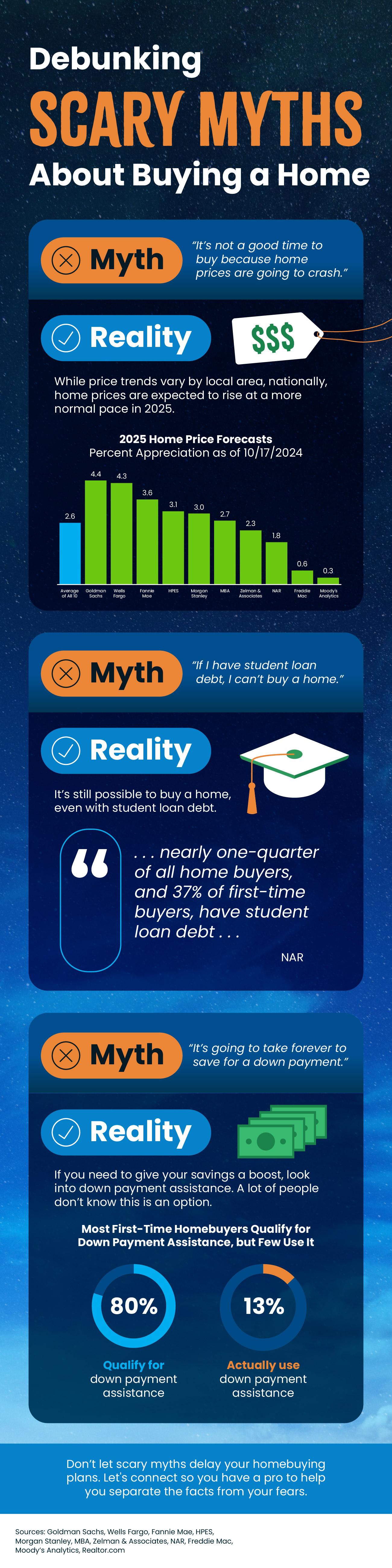

You may be seeing misleading headlines about a potential market crash, falling prices, and more. And when you’re not an expert yourself, it’s easy to get swept up in the clickbait and let that scare you. As Jason Lewris, Co-Founder and Chief Data Officer at Parcl, says:

“In the absence of trustworthy, up-to-date information, real estate decisions are increasingly being driven by fear, uncertainty, and doubt.”

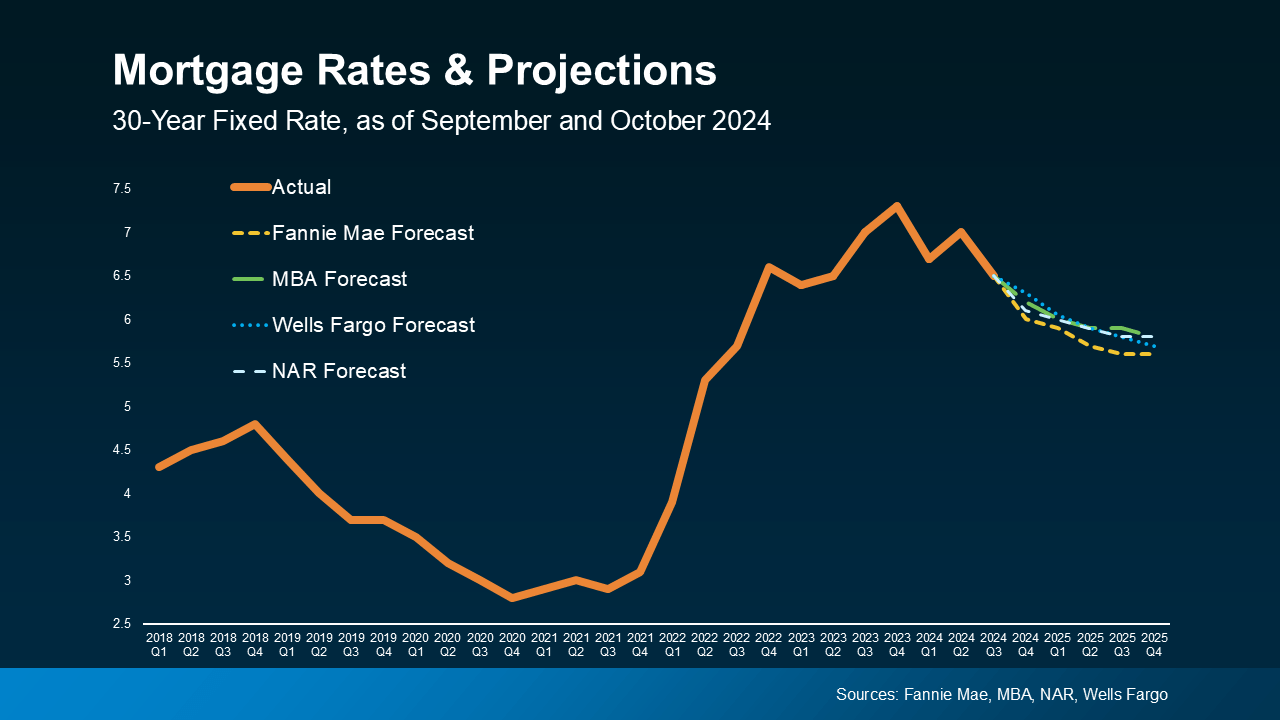

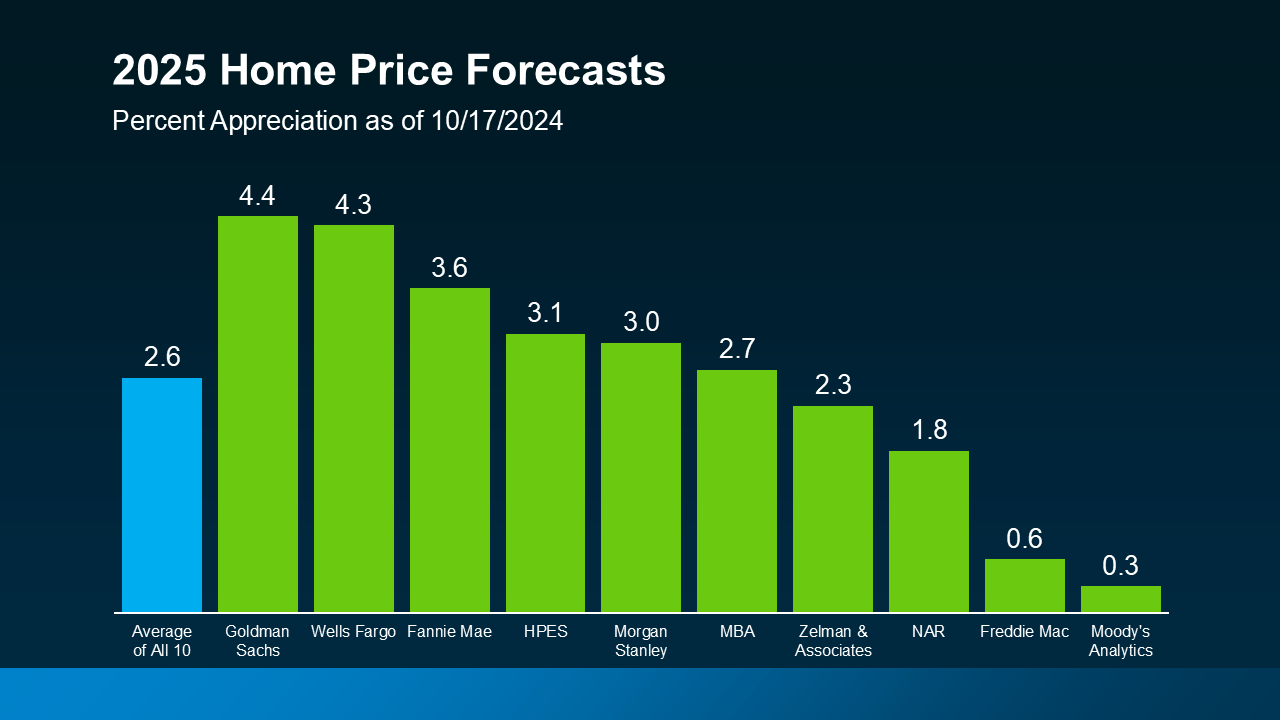

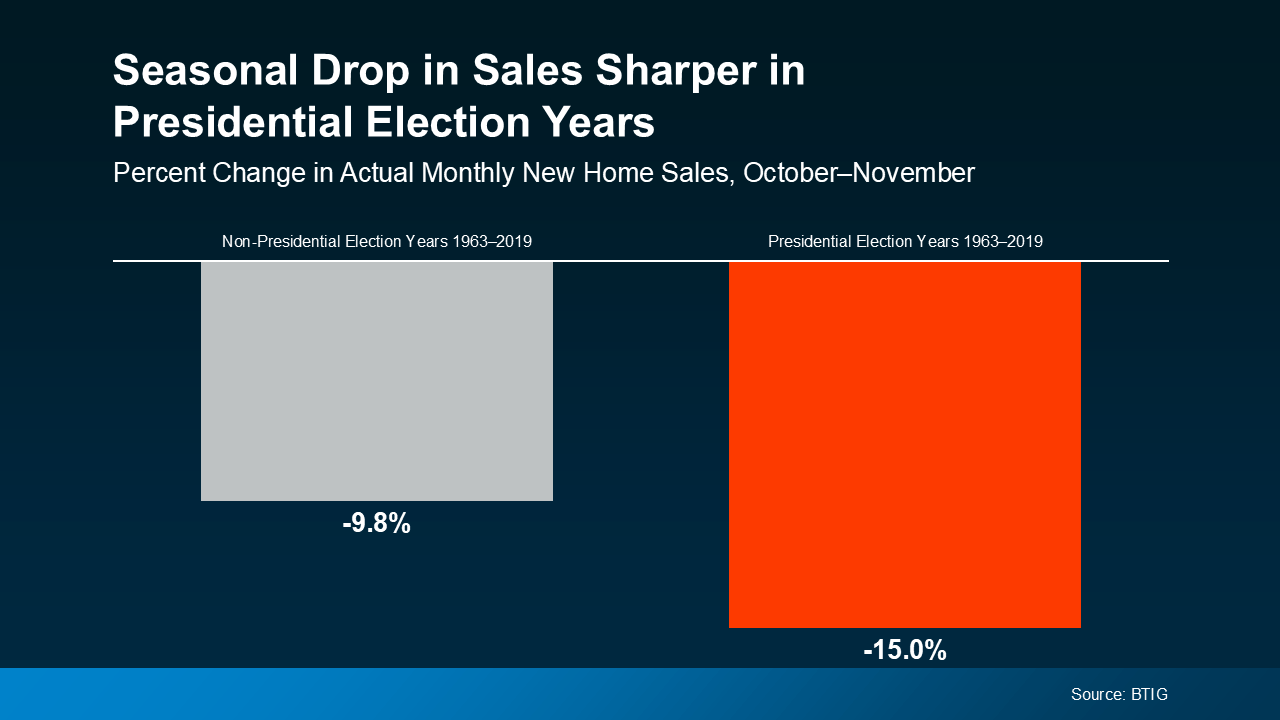

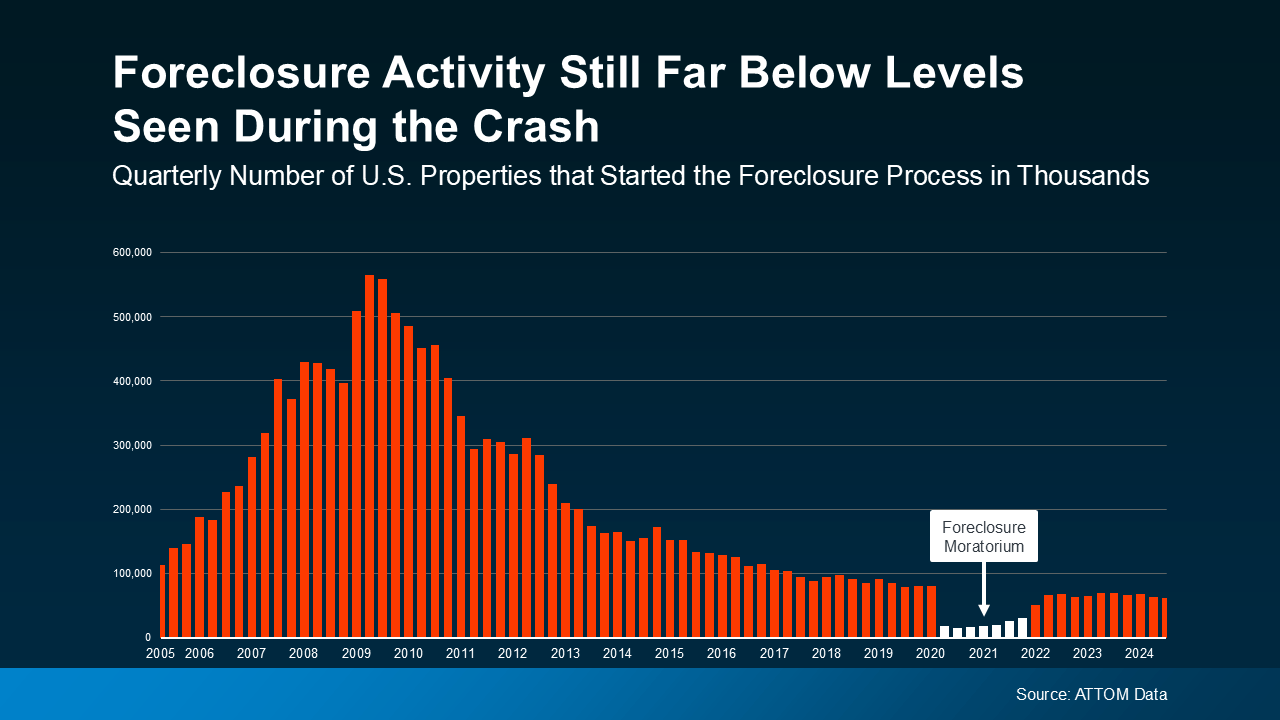

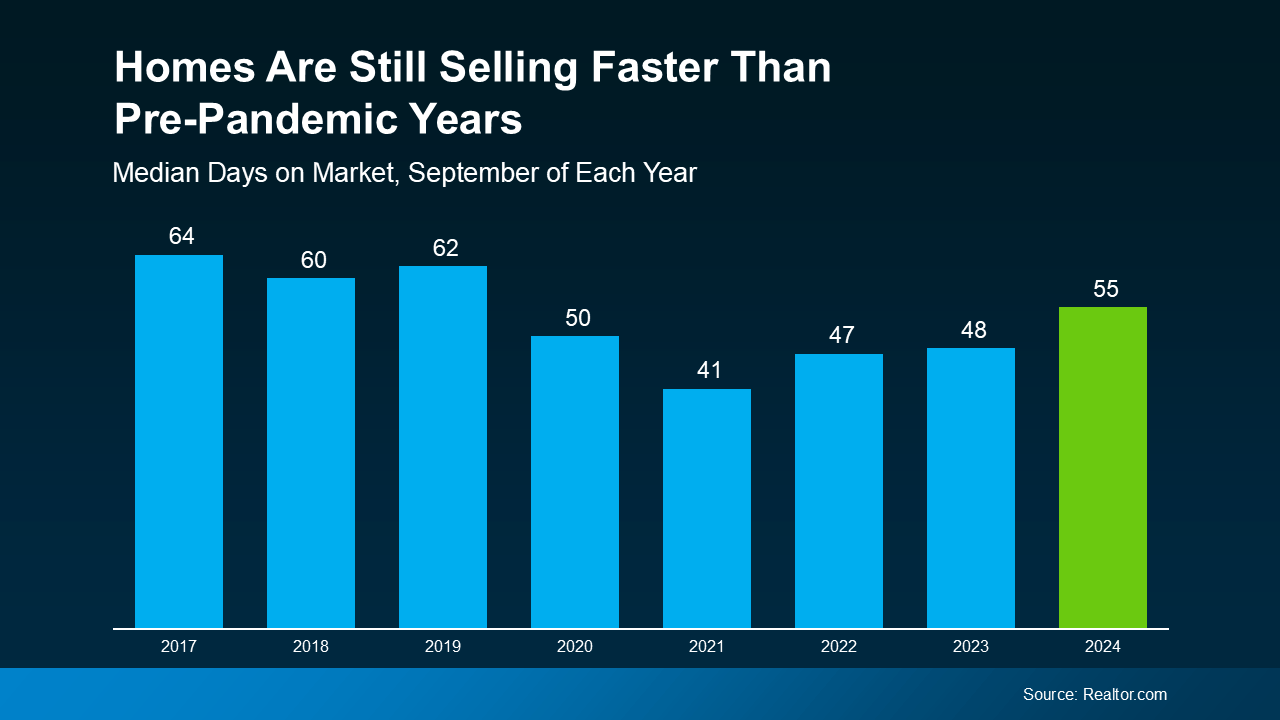

A real estate agent is there to help you separate fact from fiction and to debunk any headline that does more to terrify than clarify. With their deep understanding of local market trends, home values, inventory levels, and more, they’ll help you feel more confident in your decision.

2. Walking You Through the Process Step-by-Step

Is this your first time going through the process as a buyer or a seller? Don’t worry. Your agent will walk you through every step along the way, from the initial conversation all the way to closing day. As NerdWallet explains:

“If it’s your first time buying — or selling — you’re likely to come across terms you don’t recognize and tasks that seem baffling. What’s the difference between pending and contingent? Why do you need title insurance? How thoroughly do you need to fill out disclosure forms? Your agent should be able to confidently and competently explain it all.”

And if you’ve done this before, but it’s been a while, an agent will tailor how they explain it all to your previous experience. They won’t bog you down with details, they’ll only give you as much of a refresher as you want and need.

3. Advocating for Your Best Interests

Does the thought of dealing with the back and forth of the transaction make your palms sweaty? Put that anxiety aside. Your agent is a skilled negotiator trained for these exact scenarios. And the best part is, they work for you. So, it’s your goals they’re using that expertise to fight for.

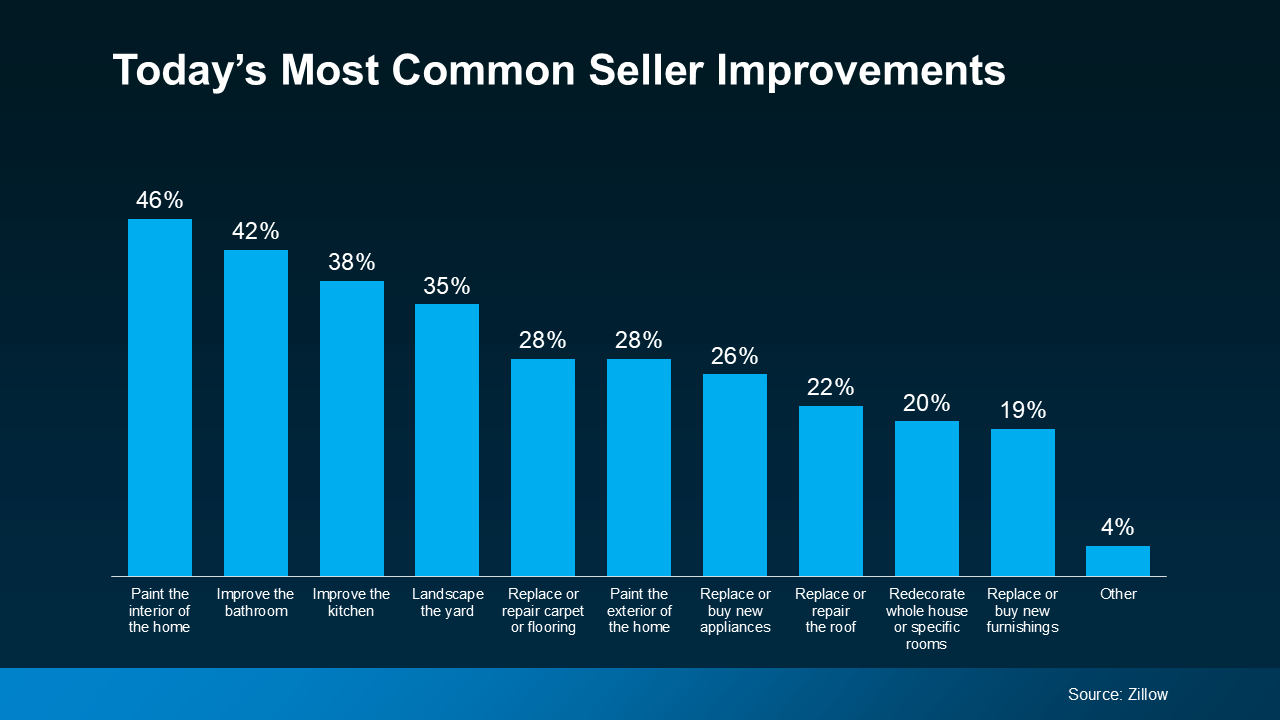

They’ll work to secure the best possible terms for you, whether it’s getting a better price as a homebuyer or negotiating a higher sale price as a seller. This removes the fear of a bad deal or being taken advantage of during the process.

4. Solving Any Unexpected Problems Quickly

Worried something is going come up that you don’t know how to handle? Rest assured, your agent has you covered.

Agents are skilled problem-solvers. They not only address issues, but they get ahead of them before they become deal-breakers – and that helps keep the process on track. So, if any challenges do pop up, know your agent has the skills and experience necessary to find a solution that works for you.

Bottom Line

Don’t let fear or uncertainty hold you back from achieving your goals. With an expert agent by your side, you can move forward with confidence.

The Importance of Working with a Local Agent

The Importance of Working with a Local Agent